The race is on for the business world to figure out how to sustain economic growth and go carbon-free.

The penny seems to be dropping that avoiding climate action comes with financial risks. Last October, 200 of the world’s largest multinational companies said they would achieve net-zero carbon emissions by 2050. Among them were Asian companies in sin industries linked with spotty environmental records such as Sinopec and Asia Pacific Resources International Limited (APRIL). Chevron, Philip Morris and DuPont were also among those that made pledges.

By 2050, climate change will shrink the global economy by 3 per cent as drought, flooding, crop failure and infrastructure damage become more severe — unless drastic action is taken to bend the curve on global warming, according to a report by the Economist Intelligence Unit.

The Covid-19 pandemic — which has been called a “dress rehearsal” for climate change — has accelerated the urgency to mitigate the impacts of climate change which cost the global economy billions every year.

“Suddenly, corporates have realised that if we’re going for a 1.5 degrees Celsius cap on global warming [the goal of the Paris Agreement on climate change], we have to hit net zero by 2030. It’ll be very expensive to decarbonise any later,” said Malavika Bambawale, Asia Pacific head of sustainability solutions at Engie Impact, a decarbonisation consultancy.

“What is the cost of not decarbonising? That is the question businesses should really be asking themselves.”

Pratima Divgi, director, Hong Kong, Asean, Oceania, CDP

Western businesses have led the way, with the likes of Microsoft saying it will make “the biggest commitment in our history” by removing all of the carbon it has put into the atmosphere since its founding in 1975. Asian companies have been slower to commit. “A lot of Asian companies are further down the supply chain, so they can hide for longer,” says Bambawale.

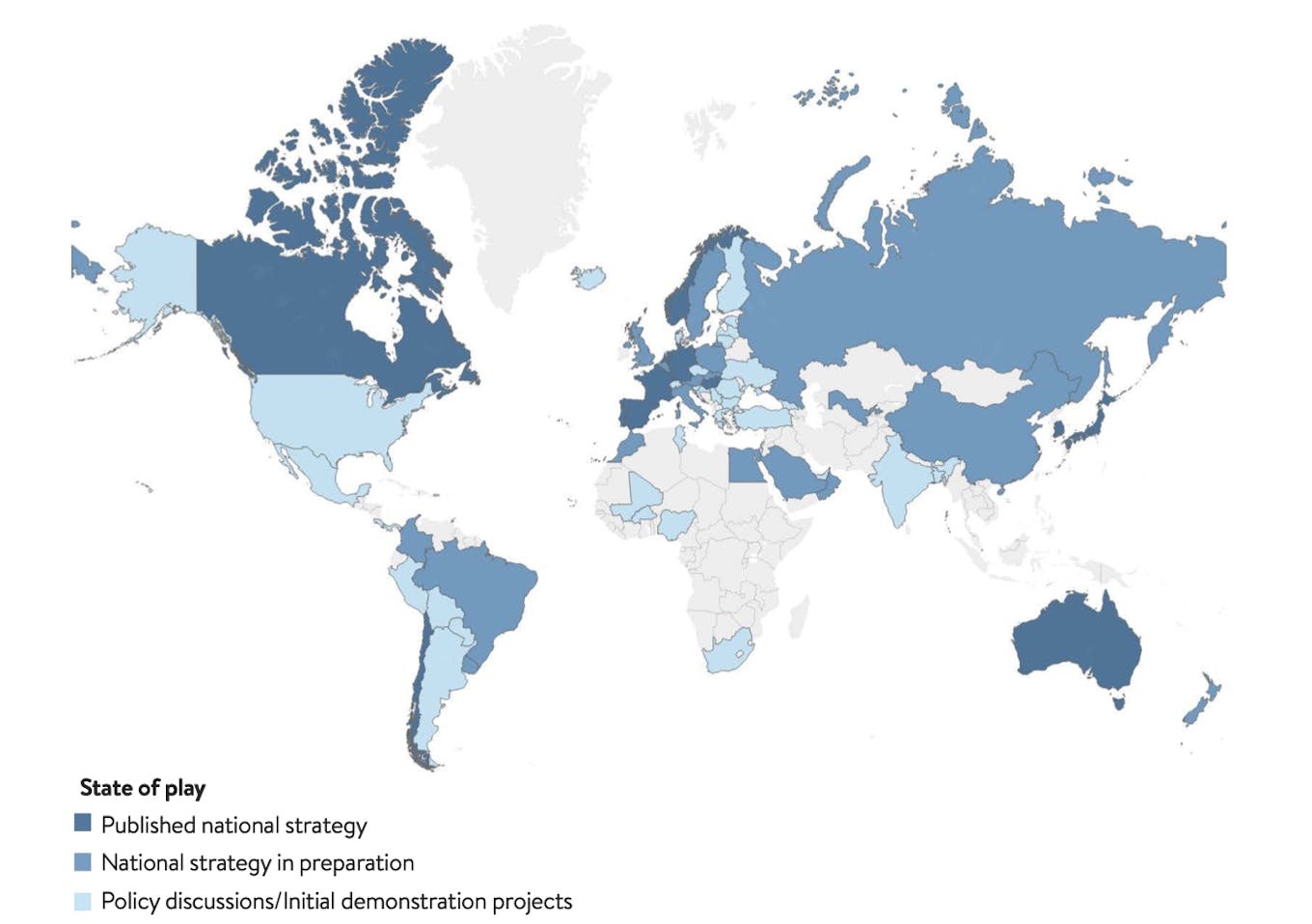

But climate action in a region that produces more than half of global emissions is cranking up. Of the 1,200 or so firms that have signed up to the Science-Based Targets initiative (SBTi), which helps companies cut their emissions in line with the Paris Agreement, 250 Asian companies have set carbon-cutting targets or are in the process of getting targets approved — a 57 per cent increase between 2019 and 2020. Forty-eight of those 250 firms have aligned their business models with the Paris agreement.

“From a small base, corporate decarbonisation is growing in Asia Pacific,” says Pratima Divgi, Hong Kong, Southeast Asia, Australia and New Zealand director at CDP, a carbon disclosure non-proft that co-developed the SBTi. Companies that have signed up to the SBTi include Hong Kong real estate firm Swire Properties, Chinese computer giant Lenovo, and Malaysian textile firm Tai Wah Garments Industry.

National-level policy commitments, like China, Korea and Japan’s net-zero declarations over the past six months have set the tone for Asian corporate decarbonisation. Competition is helping. Australian supermarket chain Coles declared a 2050 net zero target six months after rival Woolworths did the same, and Singaporean real estate firm City Developments Limited (CDL) made a net zero pledge the week after competitor Frasers Property. Gojek and Grab are racing to be the first ride-hailing app in Southeast Asia to declare a decarbonisation target.

“Now that market leaders such as CDL have made net-zero commitments, it will be harder for their competitors to sit and wait,” says Bambawale.

Malaysian oil and gas giant Petronas announced in October that it would hit net-zero by 2050, a month after PetroChina, the region’s largest oil company, said it would be “near-zero” by mid-century.

Aspiration versus reality

But questions hang over how Asia’s big-polluters will realise their declared targets. Ensuring the big emitters share detailed plans and a budget to support their carbon neutral declarations is key for accountability.

PetroChina’s announcement came with “frustratingly little detail”, commented renewables consultancy Wood MacKenzie. The oil giant aims to spend just 1-2 per cent of its total budget on renewable energy between now and 2025. This compares to Italian oil major Eni’s planned 20 per cent of total spend on renewables by 2023 and BP’s 33 per cent by 2030.

Petronas’ own 2050 net-zero pledge is an “aspiration” and not a science-based target that aligns the firm with the Paris Agreement.

“Aspirational targets can only go so far — science-based targets also need to clearly allocate interim short- to medium-term targets to work out what this transformation means to your business and value chain,” says Divgi.

Setting a science-based carbon reduction target takes time. Singapore-based transport firm ComfortDelGro has given itself two years to set science-based goals, but the company avoided giving a carbon reduction timeline in its announcement earlier this month.

Other companies are also being selective with the information they make public. This could be because they do not want to reveal the extent to which they intend on decarbonising, or because they do not have a plan yet. CDL has pledged that it will be net-zero by 2030 — 20 years ahead of competitor Frasers Property — but has declined to give further detail on how it will meet this target.

CDL’s carbon commitment is limited to its wholly-owned assets and developments under its direct control, while Frasers Property is aiming to remove emissions from its entire value chain.

Why carbon dieting is difficult

For major emitters like oil and gas firms, decarbonising means transforming their business model without going out of business. Petronas told Eco-Business that meeting its 2050 target “won’t be easy”, and would require the company to “re-strategise how we do our business, with the focus no longer being on profitability or production capacity alone”.

Petronas plans include hydrocarbon flaring and venting, developing low and zero carbon fuels, capturing emissions and investing in nature-based solutions. It also plans to cap emissions to 49.5 million tonnes of carbon dioxide-equivalent for its Malaysia operations by 2024, and increase renewable energy capacity to 3,000 megawatts by the same year.

Meeting its target would “requires us to strike an equitable balance between providing low carbon solutions while still ensuring energy security and business profitability,” said the company’s group health, safety, security and environment vice-president, Dzafri Sham Ahmad.

But removing the carbon from a company’s operations is no longer deemed enough. The indirect emissions that occur in the entire value chain — known as scope 3 emissions — are becoming the new business imperative. A new report from CDP found that emissions from a company’s supply chain are on average 11.4 times higher than its operational emissions – double previous estimates. ExxonMobil’s scope 3 emissions from the use of its products exceed the national annual emissions of Canada, it was revealed in January.

“Achieving this aspiration will require us to re-strategise how we do our business, with the focus no longer being on profitability or production capacity alone.”

Dzafri Sham Ahmad, vice-president, group health, safety, security and environment, Petronas

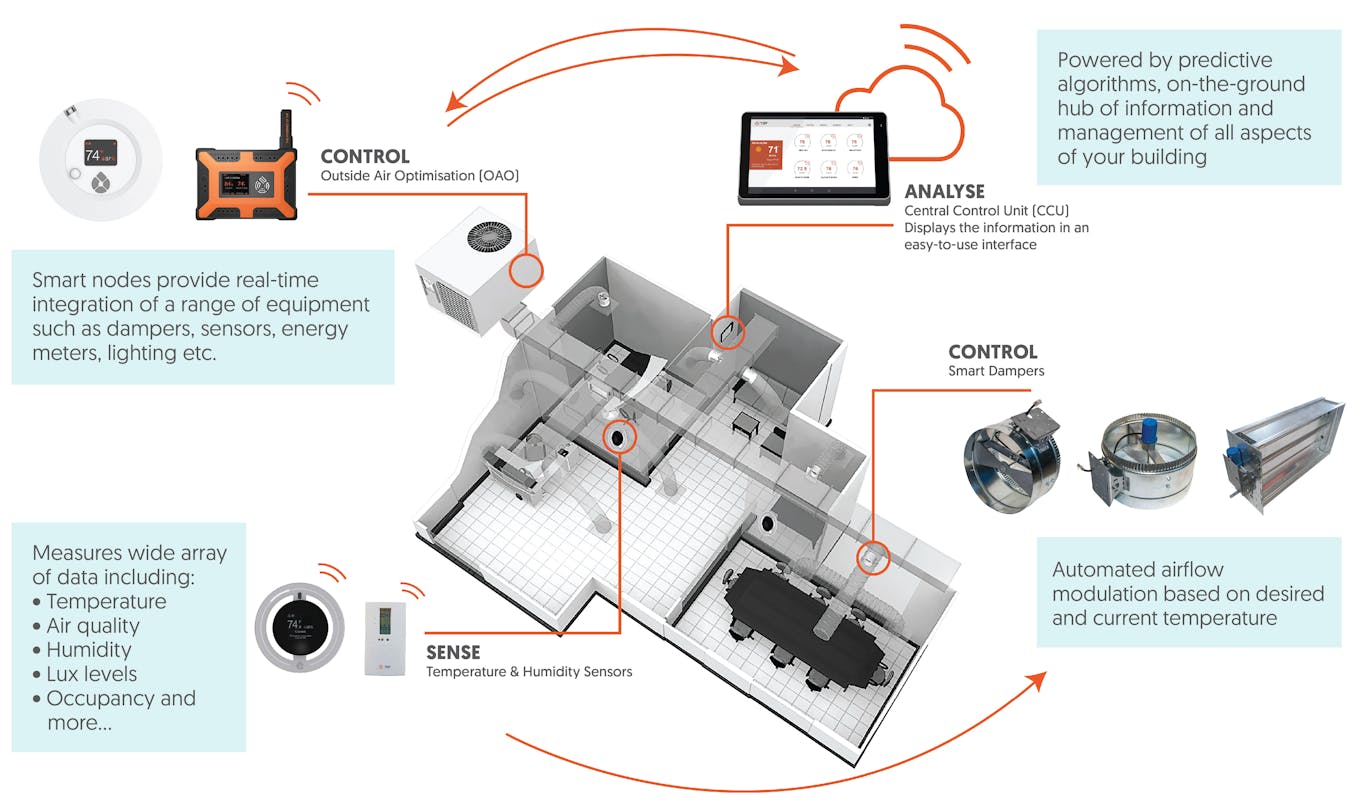

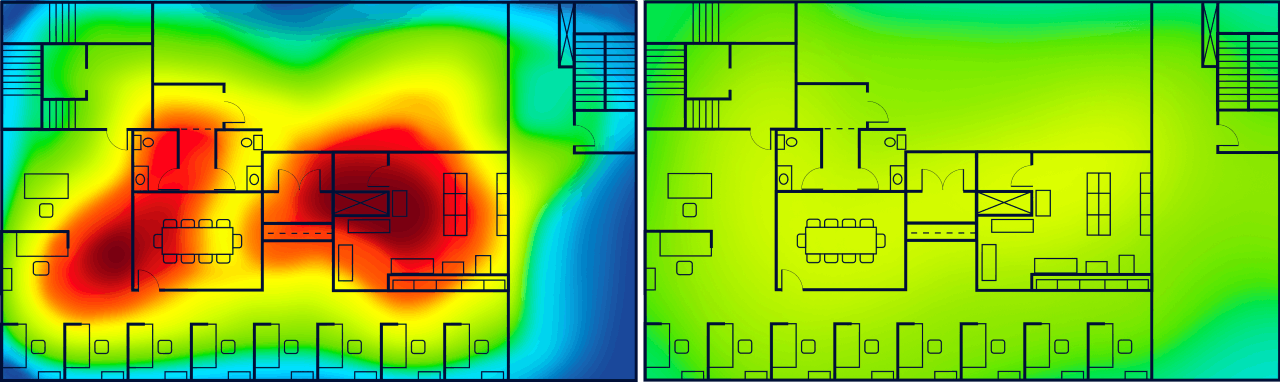

Electric vehicle makers such as Telsa are now asking questions about the emissions of their nickel suppliers while computer giant Apple wants to source low-carbon semiconductor chips. But tackling scope 3 emissions is tricky. For instance, how do Singapore construction companies reduce the imported carbon of building materials sourced from China, where electricity is generated from coal? And how does a building owner persuade its tenants to turn down the air-conditioning?

“Reducing scope 3 emissions looks easy enough from the top down. But for people in the field operating the assets it can be a nightmare,” says J. Sarvaiya, an engineer who’s an expert in decarbonisation.

Balancing the carbon books by sourcing renewable energy is also difficult in a region where fossil fuels are still the dominant power source, and where a diversity of regulatory landscapes has made scaling renewables hard and where prices remain high in places. This has led Asian companies to focus on reducing energy consumption first, before looking at procuring renewables, notes Bambawale.

But energy capping is not easy in a high-growth region with escalating energy needs. Southeast Asia’s energy consumption is growing by 4 per cent a year — twice the rate of the rest of the world — and much of that demand comes through cooling as global temperatures rise. Some 30 per cent of a business’s energy bill in this region goes on cooling, says Bambawale.

Offset or cut?

Facing so many challenges, it’s tempting for businesses to buy their way to net-zero. Carbon offsets, where companies fund projects that capture or store greenhouse gas emissions to offset their own, are becoming an increasingly popular path to carbon neutrality. Singapore state investor Temasek was one of Asia’s first companies to neutralise the carbon emissions of its operations last year, and did so primarily by buying carbon offsets. Petronas is also relying on offsets as part of its ‘measure, reduce, offset’ net-zero drive.

But offsets are drawing growing scepticism because they enable businesses to carry on as usual, without reducing their actual footprint. “Many companies find that it’s cheaper to reach net-zero by purchasing offsets. It may cost more to replace old technology with more efficient kit than buying offsets,” says Sarvaiya.

Offsets are a necessary piece of the decarbonisation puzzle — but the quality of offset is key, says Bambawale. Companies should ensure that an offset is additional—that is, the carbon reduction would not have happened without the company’s effort. It should also have permanent, rather than temporary, impact. And it should not cause any sort of environmental or social harm. Proving all of that is difficult. “Companies could spend years checking and validating that an offset is actually happening,” says Bambawale.

Offsets will get more problematic the warmer the world gets, Sarvaiya points out. The ability of plants to absorb carbon declines in a warmer world, so more trees will have to be planted to balance the carbon books. Buying renewable energy faces a similar issue. Every one degree increase of surface temperature reduces the efficiency of solar panels by 0.5 per cent.

Companies are also looking to emerging technologies to help them hit carbon goals. In Singapore, concrete producer Pan-United and Keppel Data Centres are part of a consortium that is banking on carbon capture, use and storage technology that won’t be online for another five to 10 years to reduce the carbon impact of the city-state’s oil refining, petrochemicals and chemicals sectors.

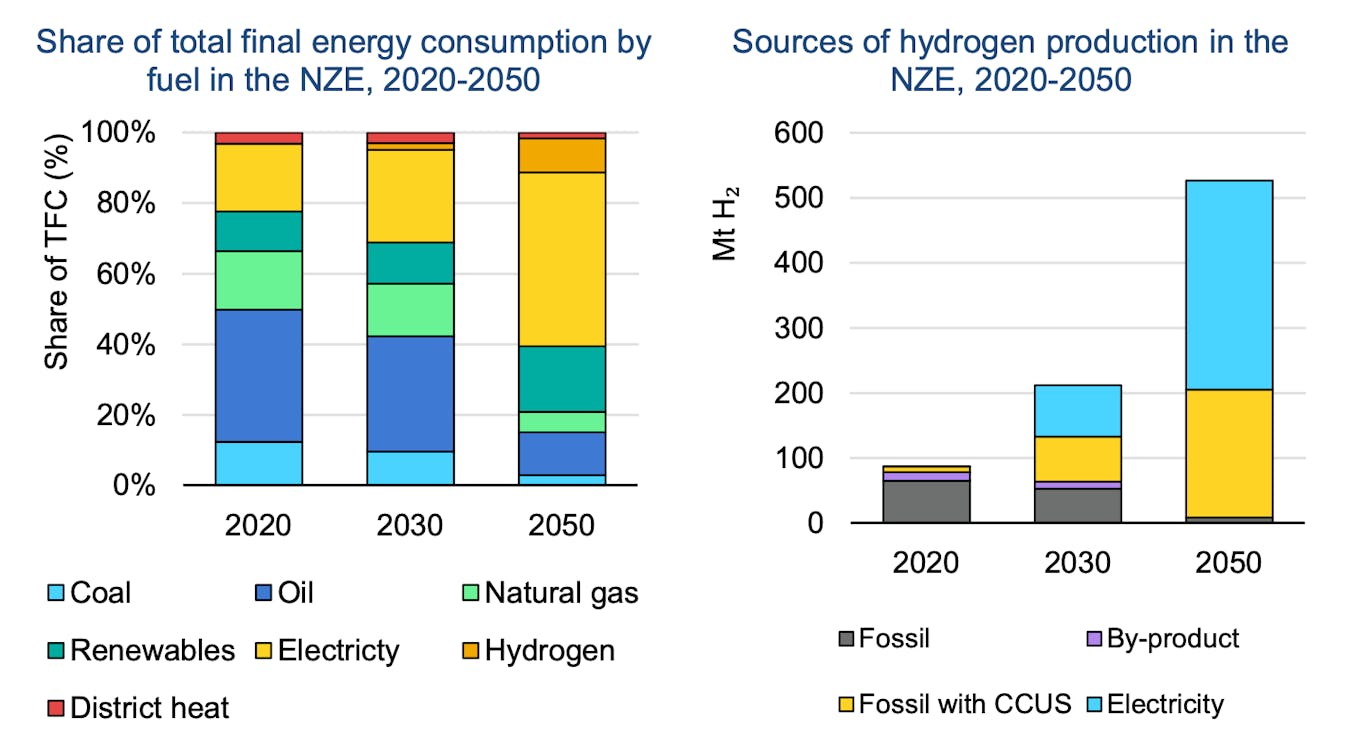

Heavy-emitting sectors such as steel production, aviation and shipping have high hopes for hydrogen power, which is considered the missing piece of the renewables puzzle. But questions over cost and transportation make hydrogen a fuel for the future for now. “Moonshot ideas should be the last step,” says Bambawale.

Why net-zero is not just hot air

In Southeast Asia, where governments have shown little interest in decarbonising their economies in their post-pandemic recovery plans, there is less incentive for businesses to cut their carbon footprints amid the struggle to stay afloat.

But a wave of commitments to decarbonisation in the past 18 months will likely lead to more. Scores of businesses have signed up for science-based targets during the pandemic, which has played a part in pushing others towards net-zero, says Divgi, adding that a Southeast Asian bank recently committed to SBTi whose suppliers’ emissions were 400 times its own.

Another indicator of interest in corporate climate action is the Task Force on Climate-Related Financial Disclosures (TCFD), a global framework for companies to disclose the financial risks they face from climate change. CDP has seen a 20 per cent increase in TCFD disclosures in Asia over the last year, Divgi notes.

More companies are trying to assess the financial implications of the transition to a low-carbon economy, and the more progressive companies have recognised that calculating climate risk is not a reporting exercise, it’s a strategic one, says Divgi.

“We’re not saying that it [decarbonising] is without problems. There’s a huge level of transformation involved, but climate change presents both a financial and an existential challenge for many businesses,” she says.

“What is the cost of not decarbonising — that is the question that businesses should really be asking themselves.”

By Robin Hicks

Source Eco Business