Countries have gathered to negotiate the final details of a global bid to keep planetary warming under 1.5-2C. Olivia Wannan reports from Glasgow.

ANALYSIS: The world has agreed to ramp up climate action even further this decade, spend more on adaptation, and even for the first time, agree that (some) fossil fuels must go.

The two-week UN climate summit in Glasgow has ended in a joint compromise from nearly 200 countries, including on a number of outstanding sticky issues in the Paris Agreement “rulebook”. Developed countries have also acknowledged they have a legal and moral obligation to help vulnerable countries with the permanent loss and damage they are already suffering – though punted a solution to future meetings.

And a last-minute capitulation to phase down rather than phase out coal power cast a shadow over the Glasgow pact. In the end, the measure of success will depend on where history sets its benchmark.

If we use the lowest bar for success – whether there is more global climate action today than there was two weeks ago – then the 26th Conference of the Parties (or COP26) has achieved that.

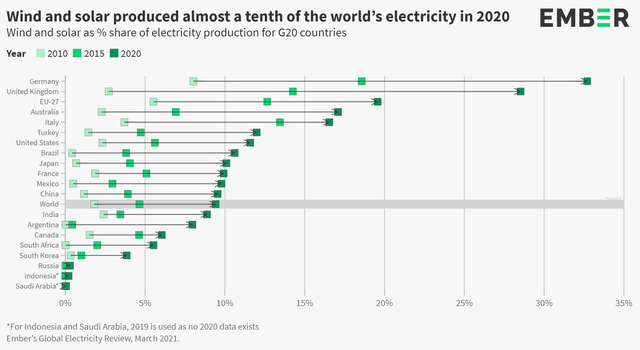

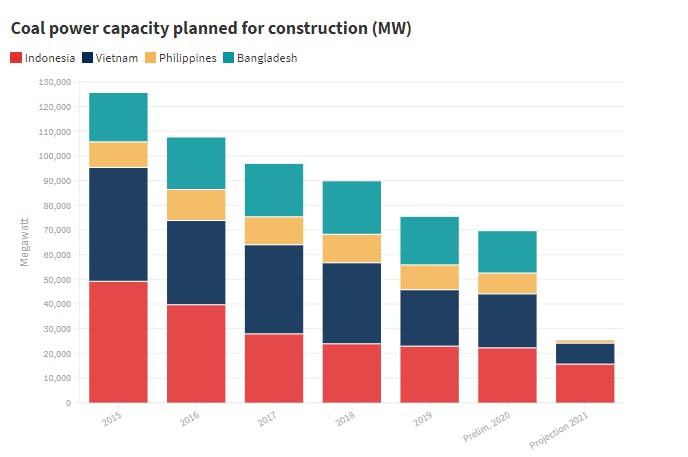

The announcement that India had set a net-zero target was a pleasing development, even if the target date is 2070 and its short-term pledges remained unambitious. Indonesia’s and South Korea’s pledges to phase out coal-power was also good news. Canada and the US made large commitments to reduce fossil methane leaks (and, interestingly, agricultural emissions) and got nearly 100 other countries to sign up.

And while China declined to join the methane pledge, it did sign a deal with the US late in the second week, which included commitments to regulate methane leaks and limit deforestation.

Were governments ambitious enough?

If the point of success is 1.5 degrees Celsius, then the conference will not earn that accolade. Climate modellers have been tracking the plethora of commitments and coalitions launched during the meeting. Even on the basis that every single one will be met (a prospect many doubt), that path would hold warming to 1.8C. Scientists warn that the effects of climate change get vastly worse with even a fraction of a degree, so there is a lot of human suffering between 1.5C and 1.8C.

In addition, experts have also exposed the large gap between countries’ long-term goals and the short-term action they’re prepared to take.

Short-term goals are outlined in each country’s Nationally Determined Contribution (or NDC). These look out to 2030 – a point when carbon dioxide emissions would need to nearly halve, according to the world’s climate scientists, to keep 1.5C within reach. The path set by these and other pledges out to 2030 put the world on a path to 2.4C.

With this in mind, countries that have not yet updated their NDC have been officially urged to submit tougher targets before COP27, to be held in Egypt. In fact, all countries are being requested to revisit their targets by the end of next year to ensure they align with 1.5C to 2C of warming (though this is caveated to take into account national circumstances).

It’s hoped big emitters such as China, Russia and Australia might then come to next year’s meeting with NDCs that could shift the global temperature dial even further still. Climate Change Minister James Shaw has already poured cold water on the idea of the New Zealand Government following this recommendation.

The onslaught of coalitions and alliances – on everything from methane and fossil fuel extraction to deforestation – announced during COP26 will supplement countries’ NDCs. There was plenty of criticism that these were voluntary, with no compliance. For example, if New Zealand fails to produce its intended methane savings of 10 per cent by 2030, the Global Methane Pledge won’t come after us in any way, beyond a public shaming.

But that’s a pattern set by the Paris Agreement itself. There are some seemingly mandatory features for the 197 countries signed up – such as reporting and deadlines for new targets. But even those aren’t well enforced: New Zealand missed the deadline to strengthen its NDC. We just scraped in before the start of COP26.

During a short speech on the final day, Shaw reflected on the shortcomings of the proposed agreement: “Is it enough to hold warming to 1.5C? I honestly can’t say that I think that it does. But we must never, ever give up,” he said.

“The text represents the least-worst outcome. The worst outcome would be to not agree [on] it, and keep talking through next year and deter action for yet another year.”

Countries in the naughty corner

Large greenhouse emitters China and Russia were called out for not showing up, literally and figuratively. Chinese president Xi Jinping and Russia president Vladimir Putin did not attend the leaders’ summit at the beginning of the talks, though negotiating teams for each country did attend to get the Paris Agreement “rulebook” and other outstanding matters settled.

By COP26, all 197 countries in the Paris Agreement were supposed to “ratchet” up their ambition. Russia updated its pledge last year, though it was deemed little better than its old one.

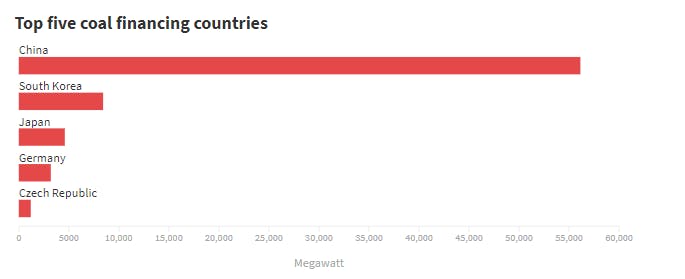

In 2020, Xinping announced a new pledge: that his country’s emissions would peak before 2030 and that China would reach net zero by 2060. This year, he formalised those commitments and promised to stop financing coal-fired power plants in other countries.

The Chinese leader is known to save his major climate announcements for UN general assembly events, rather than play to the COP timetable.

But similar criticism could be aimed at New Zealand, with Prime Minister Jacinda Ardern not attending the talks and – more importantly – taking few concrete steps during the two weeks.

The Government did increase its NDC, before the summit began. Ardern promised to save 149 million tonnes of carbon dioxide over the next decade.

Billed as a halving of emissions, Climate Action Tracker said – minus the creative maths – this was closer to a 22 per cent cut (a target now rated as “almost sufficient” though not our fair share).

And even that won’t require the country to take additional action domestically. (Thus, New Zealand retained Climate Action Tracker’s “Highly Insufficient” rating).

New Zealand is still planning to emit roughly the same amount of net emissions between now and 2030 as in the budgets proposed by the Climate Change Commission earlier this year. So now, the Government will just buy a few more carbon credits from other countries.

During the summit, New Zealand also signed up to a number of pledges without taking any major new steps. No new policies will be required for the Government to meet the Global Methane Pledge – because it’s a collective goal to reduce methane by 30 per cent, New Zealand can simply make the cut of 10 per cent it’s already obliged to under the Zero Carbon Act.

Similarly, our new membership in the pledge to end deforestation or in the Beyond Oil & Gas Alliance required little extra.

In sum, the Government has done little but spent more money: committing to a larger carbon credit bill, and also increasing foreign aid towards mitigation and adaptation for developing nations – which it bumped up to $325 million each year.

Still, New Zealand behaved better than our trans-Tasman neighbour. Australia refused to boost its NDC, stayed far away from alliances cutting methane and coal, and initially attempted to block declarations on phasing out fossil fuels.

An emotional Mary Robinson, Chair of @TheElders and former President of Ireland slams leaders for not being in crisis mode and blames Saudi Arabia for blocking @skynews #COP26 Today will be very important. pic.twitter.com/BxEcXzGptg

— Samantha Washington (@skynewsSam) November 10, 2021

Did they show us the money?

Climate finance was a critical item on this year’s agenda. In return for a commitment to begin cutting emissions, developed countries promised – by 2020 – to deliver $100 billion to developing countries each year.

That deadline was missed, but the COP26 organisers hoped to pull a few additional commitments out of large economies. Early in the talks, the goal appeared to be within reach after the Japanese prime minister agreed to bump his country’s share up by $10b.

Yet with the US arguing their hands were tied by a requirement to get permission from Congress, there were few other large economies to come to the table. As the summit closed, this goal remained unmet.

Australia was a relative Scrooge: prime minister Scott Morrison doubled his contribution – to AU$2b (NZ$2.08b) – whereas New Zealand quadrupled its cash to NZ$1.3b.

As well as meeting the old goal, the talks turned to the next climate finance target.

There wasn’t much progress on setting a new goal for mitigation finance, apart from a call for discussions to begin. Finance in the form of loans – a bugbear of developing countries – wasn’t ruled out. On a brighter note, rich countries are urged to “at least” double the cash put towards adaptation.

Another request of developed countries was for the finance they were owed, under the legal precedent of loss and damage, for the permanent effects that climate change was already having on their lives. In the Pacific, this includes the loss of land to sea level rise and salinisation, plus the loss of GDP from extreme weather events that had become a permanent part of storm season.

Three philanthropies offer £3m to help set up a Glasgow Loss and Damage Finance Facility, nudging developed countries resisting calls to create one https://t.co/5gwTXfsLAG

— Simon Evans (@DrSimEvans) November 12, 2021

Developed countries had contributed the lion’s share of the rise in greenhouse gas, and therefore – the argument goes – should have to stump up that share of the costs.

And while developing countries welcomed the help from a proposed network that would offer them technical assistance in dealing with these permanent issues, they also wanted cash for reparations. This was a point of principle for many. In the end, the countries decided that this scheme “will be provided with funds”, though specific numbers will need to be discussed.

The biggest sticking points

The summit’s to-do list also included the finalisation of the Paris Agreement “rulebook”, which would specify how the landmark 2015 accord would actually work in practice.

A number of sticky issues – including how countries might create and trade carbon credits between one another and what information would be required to be submitted on a regular basis – had failed to be resolved at previous meetings.

One of the most contentious debates revolved around who could claim credit for carbon-cutting projects paid for by others. Many countries – including New Zealand – maintained that the global carbon maths must be balanced: if carbon credits were sold, then the purchasing country (or company) would adjust its emissions tally down and the host country must adjust its tally upwards.

But Brazil in particular argued that the host should, essentially, be able to have its climate cake and eat it.

To settle this issue, a proposal to create two types of carbon credits was put on the table. There would be higher-quality credits to be sold to other countries and airlines in an international pact. In addition, there would be a lesser type of credit, offered to private companies.

The host country of carbon cutting projects now holds the power to authorise higher-quality credits. When that happens, the balanced carbon maths (that New Zealand and others want) would be required.

It can also authorise lesser credits. While these would be paid for by someone else, the host country could claim the environmental benefits when it reported its progress towards its NDC.

Experts, including Environmental Defense Fund’s Kelley Kizzier, said this system appeared robust – though it may need keeping an eye on.

It’s debatable how many companies would want these lesser credits, since they may not be able to use carbon-neutral claims, for example.

However, activists were worried that giving host countries authorisation powers might allow them to flout safeguards, such as protections for human rights.

Another area of contention was on old carbon credits, dating back to the predecessor of the Paris Agreement, the Kyoto Protocol. Many Kyoto carbon-cutting projects had issued credits that remained available for sale.

Climate activists hate this idea, criticising these old units as “zombie credits”.

But the host countries of some of these projects – notably Brazil – did not want to lose the value of the units. They argued that the schemes, which were reducing emissions, could collapse without funding.

In the talks, some countries signalled they’d be open to allowing these projects to transition into the new system, but wanted to restrict the number of “carryover credits” issued before 2020, when the Paris Agreement took effect.

A consensus was struck, allowing some old credits to enter the new system. There were a few limitations: the project had to have started after 2013, with the credits issued before 2021, and these could only be used towards a country’s first NDC. This is one compromise likely to receive heavy criticism from climate activists in the coming days.

The purchase of these old credits will weaken, or completely undermine, the NDC of any country that uses them.

Speaking earlier in the week, WWF carbon market expert Brad Schallert said it is risky to allow these credits, even if there’s no appetite for them. They “blow a hole” in the Paris Agreement, he added.

“If no one buys them, then we’d be okay,” he added. “But we have to assume the worst.”

A proposal to limit the number of carbon credits a country can use to achieve its NDC made it into the rulebook. New Zealand negotiators opposed this provision strongly – if set high enough, this could seriously mess with the Government’s plans to outsource up to 68 per cent of its carbon-cutting pledge.

But the work to set this limit won’t start until 2028, meaning it’s more likely to be an issue for the next NDC period, beyond 2030.

What climate activists fought for

Considering the failure of “Global North” countries to produce the $100b on time, one hot-button issue during the summit was a suggestion that every carbon trade should provide a 2 or 5 per cent cut of the proceeds to an adaptation fund, to help vulnerable communities.

It wasn’t just the percentage that negotiators were haggling over, but the types of trade involved. The Paris Agreement specifically links this idea to the international carbon market, so some negotiating teams (including New Zealand’s) thought this shouldn’t apply when countries trade directly with each other. But developing countries argued this would simply be a loophole, and wondered why anyone would design a carbon trading system with one type of credit undermining another.

This debate was also linked to a proposal to gift an “angel’s share” of all credits purchased to the Earth. If rich countries outsource their carbon goals to others, then this would give an additional boost, argued vulnerable countries (which are the keenest to see ambitious climate action). Shares of up to 30 per cent were suggested.

In the end, countries settled on 5 per cent for adaptation, and 2 per cent for the planet, for any carbon credits sold on the international market.

But when countries trade credits directly between one another, they are only “strongly encouraged” to provide a share of the proceeds for adaptation and donate another cut to the Earth. This would mean a country such as New Zealand would be named and shamed for not doing this, but wouldn’t be breaking the Paris rules.

One of the passion projects of many New Zealand activists and attendees was to get protections for human rights and the rights of Indigenous people into the Paris rulebook. This would ensure that any projects using foreign funds to reduce carbon emissions would not come at the expense of vulnerable communities.

This was identified as a problem under the pre-2020 Kyoto credit system. The New Zealand negotiating team said it lobbied strongly for these rights to be included and the proposed rules to be as tough as could be.

This was successful: projects will need to demonstrate how they will protect these rights, both in the initial design of the scheme and in regular reports. The push to get an independent body to assess grievances was also successful.

How much should developed nations pay for damages due to climate change? It’s a major #COP26 flashpoint, and these @nyt charts dive into 170 years of CO2 emissions that show a huge rich/poor divide that’s not going away after Glasgow. https://t.co/TBH8xchx2R

— EDF (@EnvDefenseFund) November 13, 2021

A fight to get 197 countries to agree to some joint commitment calling time on fossil fuels was a major bone of contention at the 11th hour. To avoid annoying countries that export a lot of fossil fuels, the Paris Agreement doesn’t mention them at all.

As Saturday began, the proposed joint summary from all countries called for accelerated efforts to “phase out” both unabated coal power and inefficient fossil fuel subsidies. The US pushed to keep in the qualifiers “unabated” and “inefficient”, which weaken the proposal. It would, for example, allow coal power stations with carbon capture. The efficiency of subsidies is also a subjective assessment.

On the final day, China, India, Iran, Nigeria, South Africa and Venezuela voiced their opposition to this call.

India even argued that developing countries are “entitled” to use fossil fuels. The country’s negotiators proposed the watered-down “phase down” replace “phase out” related specifically to coal power.

This didn’t go down well: the Swiss negotiator pointed out the amendment would make it harder to reach 1.5C, and received a long round of applause. COP26 president Alok Sharma, who set out to “consign coal to history”, became visible upset when discussing the concession.

In the end, the wording was reluctantly passed – so the package of wider measures could be as well.

While hardly progressive, fossil fuels still took a small hit, and the call could pave the way for stronger language at future COPs.

Let's remember that despite this watered-down language, this is the first COP decision to mention coal (even "phase down"), and fossil fuel subsidies. #COP26

— Natalie Jones (@nataliejon_es) November 13, 2021

All in all, the sheer volume of competing interests means COP26 was unlikely to be capable of producing an agreement that any single person would prefer.

There will be a lot of interpretation of what it got wrong. But getting nearly 200 countries to collectively move, even on this existential issue, is a mammoth undertaking. For just a day or two, that needs to be celebrated.

The judgement of the world, particularly the young, was on negotiators’ minds. On Friday (Saturday NZ time), European Union climate chief Frans Timmermans held up a photo of his grandchild, and shared his concern about the young child’s future.

A day later, Tuvalu Climate Minister Seve Paeniu shared a photo of his three grandchildren. “Glasgow has made a promise to secure their future – that will be the best Christmas gift that I will present to them.”

Source Stuff