As the world confronts the growing urgency of the climate crisis, hyperscale computing companies are stepping up their sustainability efforts. In recent years, cloud titans have emerged as the largest buyers of renewable energy, with the clean energy portfolios of Big Tech sometimes rivalling those of the world’s biggest utilities.

According to latest data from Bloomberg NEF, Amazon has been the largest corporate clean energy purchaser in the world for the second year straight. Globally, a total of 6.2 gigawatts (GW) of renewable energy was purchased in 2021 through 44 offsite power purchase agreements (PPAs) in nine countries by the tech giant. The company now has 310 renewable energy projects around the globe, with capacity to generate over 15.7 gigawatts of energy, making it one of the world’s clean energy leaders.

However, despite the growing ambition and appetite of these companies, their 100-per-cent-renewable energy goals remain out of reach in some parts of Asia, primarily due to a lack of affordable clean power options.

Ken Haig, who leads Amazon Web Services (AWS)’s energy and environment policy engagement efforts, says governments in the region can encourage corporate renewable investments by setting up regulatory frameworks that incentivise the adoption of affordable and renewable energy. “Leading renewable energy purchasers and cloud service providers can drive the demand for clean energy and help the sector to grow, bringing with it associated capital, green jobs and the proliferation of green technologies and approaches across Asia Pacific,” he said.

Haig, who also chairs the Asia Cloud Computing Association (ACCA)’s Sustainability Working Group, was speaking at AWS’s annual Asia Pacific Sustainability Summit held on 29 June. Experts on the same panel also said that overcoming the lack of financing, accurate information and confidence will give the region the breakthrough it needs.

Enabling renewable energy projects in Asia Pacific

Earlier this month, Singapore announced it would be importing up to 100 megawatts (MW) of hydropower from Laos via Thailand and Malaysia in the first multilateral cross-border electricity trade involving four ASEAN countries. With increasing regional collaboration, foreign imports of renewable energy for renewables-scarce Singapore, will become increasingly possible. This will not only boost investor confidence in such projects, but also make the sustainable construction and operation of digital infrastructure more achievable.

Heng Jian Wei, director (policy) at the National Climate Change Secretariat (NCCS) in the Prime Minister’s Office – Strategy Group (Singapore), said: “Such projects can help spur the growth of renewable energy resources, which can be used to power the grid in the host countries as well. They are powerful as they create a win-win outcome.”

He further explained that renewable energy projects can make better financial sense if sufficient offtakers are secured, and by reducing upfront costs and enabling downstream recovery.

Haig added that Amazon’s renewable energy strategy focuses on additionality. “We identify projects to invest in as offtakers enabling additional renewable energy to help green the grids where we operate. This is what we have done in APAC as well with three projects in Australia, two in China, and one each in Singapore and Japan,” he said.

AWS is currently on track to meet its pledge of using 100 per cent renewable energy by 2025, five years earlier than expected.

Asian Development Bank’s (ADB) senior energy specialist Stephen Peters cited the international help given to construct Cambodia’s 100MW National Solar Park Project, as a further example of how governments can make renewable energy projects more economically viable and less financially daunting.

In addition to ADB’s US$7.64 million loan, the project was also given a US$11 million concessional loan and a US$3 million grant from the Climate Investment Fund’s Scaling Up Renewable Energy Programme (SREP). With funding from 14 donor countries, SREP aims to help resource-strapped nations fight the impacts of climate change and accelerate their shift to a low-carbon economy.

The project, the first of its kind in Cambodia, adopts reverse auctioning as a strategy for the government to procure renewable energy generation capacity. The competition drives down the power purchase tariff for solar. “The model was very successful because it allows risks to be shared between the public and private sectors based on who can best handle the risk. This avoids premiums due to misallocated risk and produces low energy prices,” said Peters.

Pursuing ‘green growth’ for Asia’s data centres

Data centre operators are now facing pressure to meet stricter sustainability goals. In Singapore, a moratorium on data centres, once imposed due to sustainability concerns such as the heavy electricity and water usage of the facilities, was lifted in January this year, but with regulations to ensure that their power usage effectiveness (PUE) is kept at 1.3 or below. Moreover, applications to operate new centres must include innovation and sustainability solutions, and applicants should ideally have a proven track record in building and operating data centres.

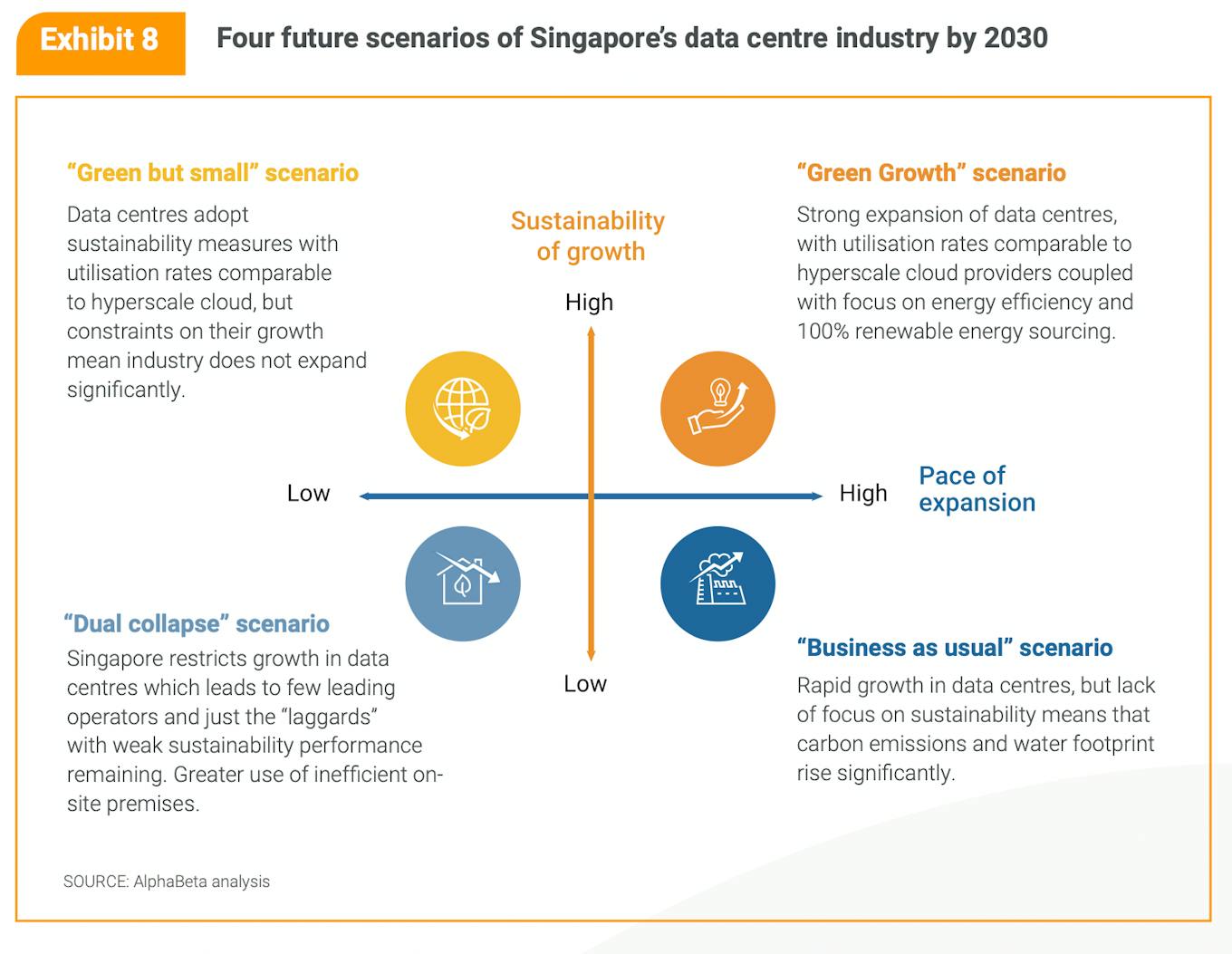

At the summit, strategic economic consultancy AlphaBeta launched a paper detailing how Singapore could achieve a “green growth” scenario, where there is ample, sustainable digital infrastructure, by providing assistance to data centres sourcing for renewable energy.

In their report, AlphaBeta developed a best case, “green growth” scenario, where if the Singapore government assists in the construction of new data centres and helps source renewable energy, digital infrastructure can not only cope with the increasing demands, but provide energy efficient services which allow the nation to reach its climate goals.

Quint Simon, who heads public policy at AWS, emphasised that countries in the region should not need to choose between digitalisation and decarbonisation, as tackling them both provides nations with viable ways of reaching their climate goals.

“Contrary to some beliefs, the twin transitions of digitalisation and decarbonisation are not mutually exclusive, but in fact, mutually beneficial. Governments across APAC can turn these parallel challenges into mutual opportunities by harnessing the demand for digitalisation to meet pressing climate commitments,” said Simon.

She urged companies to consider switching from on-site data centres to cloud computing, which can reduce energy consumption by up to 80 per cent and make net-zero ambitions more achievable.

The value of business investments and sustainability is becoming increasingly clear. Studies find that companies moving or building sustainability strategies into their digital transformation plans are two and a half times more likely to outperform their peers. And that’s not idealism. That’s good business sense. – Ken Haig, chair, ACCA Sustainability Working Group

Better data and disclosures

Experts at the AWS Sustainability Summit said that enhanced data disclosures are key to redirecting capital towards low-emissions investments.

Dr Amelia Sharman, New Zealand’s External Reporting Board’s director for climate standards, said that decision makers might still be using old frameworks. For example, some are preparing for scenarios where floods occur every once in 100 to 200 years, when in facts these extreme weather events are affecting nations every 10-20 years. She explained that these mechanisms are new and a lot of upskilling within the business, in the industry and with the investor community is necessary to support quality low-emission investments.

“We encourage entities to prioritise their investor and what is important to their investor’s decision making, when preparing climate-related disclosures,” said Sharman. “Quantitative data are an important element of the disclosures but entities are also encouraged to think qualitatively when exploring their climate-related risks and opportunities using strategic foresight tools such as scenario analysis.”

From 1 January 2023, climate-related disclosures aligned with the recommendations provided by the Taskforce on Climate-Related Financial Disclosures (TCFD) will be mandatory for all equity and debt issuers listed on the New Zealand Stock Exchange (NZX) and selected financial service organisations.

Despite the different developmental stages APAC countries are on in their decarbonisation journey, the panellists discussed the need for standardisation. Heng emphasised that it is important to try and put a price on an externality like carbon because we do pay a price for climate change impacts.

“A single carbon price for the Asia Pacific region or the world probably won’t happen anytime soon. However, an agreement on a single carbon price would be pragmatic, as it would enable greater near-term carbon emissions reductions by building confidence that all participating countries are undertaking comparable mitigation efforts.

Peters adds that “we should seek new and innovative ways to achieve a low carbon transition and regenerate our natural environment. One of the ways we can do this is by using natural capital to support blue and green bonds. Using digital solutions can accelerate this tremendously.”

Meeting Sustainable Development Goals (SDGs) with technology

During the summit, the ACCA also released a concept note outlining how cloud computing and digital technologies can help countries reach their Sustainable Development Goals (SDGs). According to the International Energy Agency, cloud-enabled technologies—such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT) and edge computing—will be critical to accelerating systemic sustainability transformation at scale.

For example, the Indonesian company Halodoc used behavioural insights from patient data stored on the cloud to connect millions of patients to 22,000 doctors and 1,000 partner pharmacies across the nation, thereby making healthcare simpler and more accessible. With wider adoption of such use cases, APAC countries can help promote their citizens’ good health and wellbeing, said the report.

Peter’s added, “Greater access to information and intelligence can support reaching the goals of the SDGs. The Asian Development Bank is exploring artificial intelligence tools to help governments analyse enormous amounts of data—for things like protected areas, wind speed, and solar radiance—to better determine, plan, and build their energy infrastructure.”

Another example is the use of cloud technology for agriculture in Asia. Farmers in Thailand and Pakistan reported a 50 per cent increase in yield and nearly 40 per cent corresponding increase in profitability after adopting cloud solutions for remote agricultural management.

Referencing this report, Haig said “The value of business investments and sustainability is becoming increasingly clear. Studies find that companies moving or building sustainability strategies into their digital transformation plans are two and a half times more likely to outperform their peers. And that’s not idealism. That’s good business sense.”

Source Eco Business